Get in touch

555-555-5555

mymail@mailservice.com

For Sale

$13,972,000 | 7.00% Cap

Properties can be purchased together or separately

Thank you. The Offering Memorandum is now accessible.

Oops, there was an error. Please try again later.

Broker of Record: Brian Brockman | Bang Realty, Inc | Multiple Licenses (See OM)

Investment Highlights

Strong Corporate Guarantee - The Heartland Dental Portfolio leases are corporately guaranteed by Heartland Dental, LLC. Heartland Dental is the nation’s largest dental organization providing support services to 1,800 locations in 38 states.

Annual Rent Escalations- The Heartland Dental Portfolio leases, with annual increases tied to changes in the Consumer Price Index (CPI), provide a robust hedge against inflation. This structure ensures rental income grows in line with rising prices, preserving purchasing power and supporting long-term asset value. Such leases are particularly attractive in inflationary environments, offering predictable and inflation-protected cash flow for investors.

High Performing Locations- The Heartland Dental Portfolio showcases strong financial performance, reflecting the tenant’s solid business operations. This stability suggests a long-term lease is likely, making it a secure investment.

Recently Acquired Practices- Heartland Dental acquired these practices between 2019 and 2022 investing significantly in integrating them into their network. This substantial commitment enhances the likelihood that Heartland will maintain long-term operations at these locations, thereby increasing the stability and attractiveness of the real estate investment.

| Facility Type | Building Area (SF) | Years Remaining | Net Operating Income |

|---|---|---|---|

| All Single Tenant | 45,633 Square Feet |

6 Years (WALT) | $976,047 |

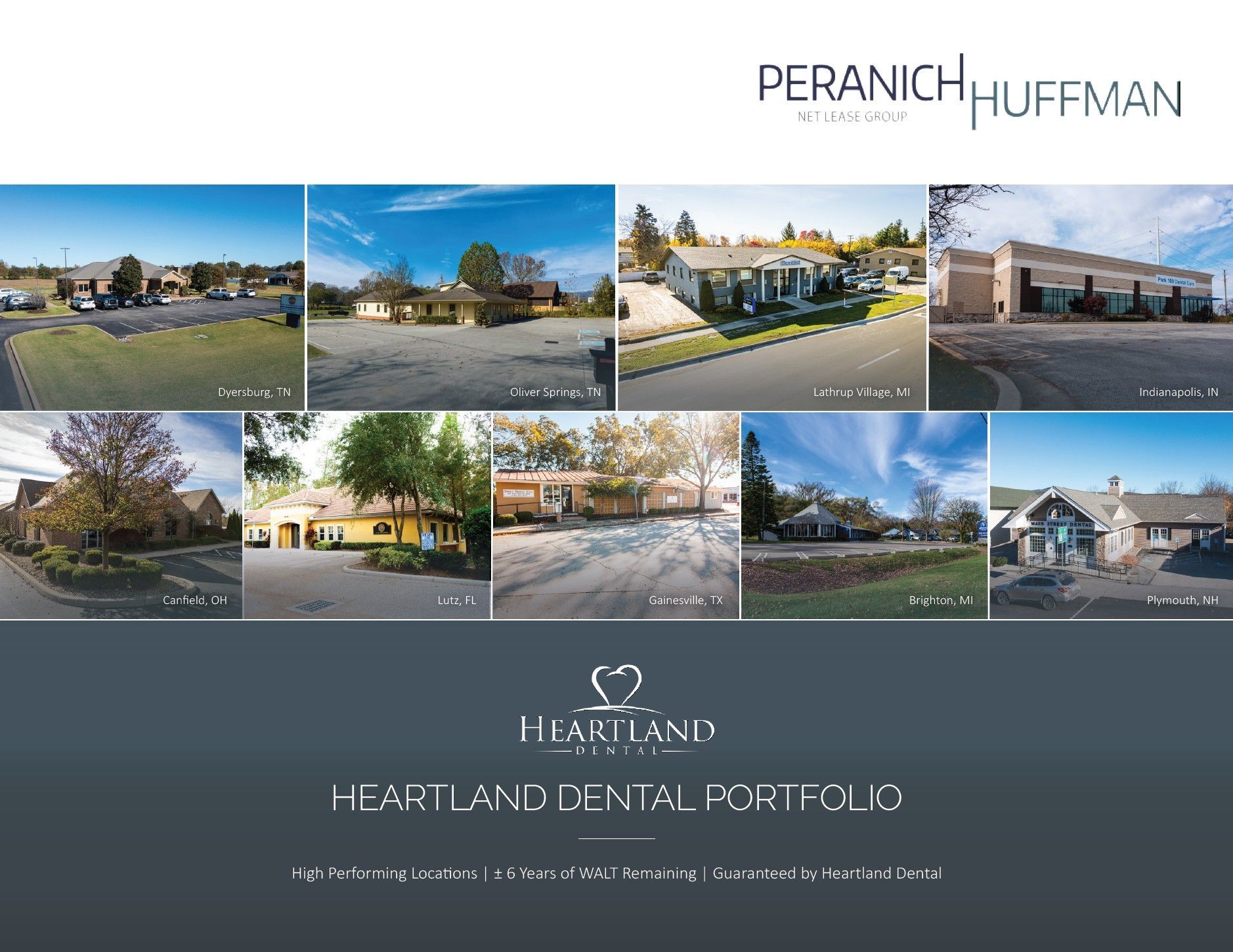

Investment Overview - Peranich Huffman Net Lease Group is pleased to offer for sale, on an exclusive basis, the Heartland Dental Portfolio. Offered at a 7.00% capitalization rate, the offering provides an investor with the opportunity to acquire 9 properties with a strong operation that is home to a national medical tenant that exemplifies a reputation of consistency for both patients and the real estate investment community.

Lease Term - Heartland Dental has occupied the 40,633 SF medical facilities since they began acquiring these operations between 2018-2022. The Heartland Dental portfolio has +/- 6 years of weighted average lease term remaining with annual rent escalations that are tied to the CPI which provides further security. All the leases call for (4) remaining 5 year options.

Net Lease Structure - The lease are structured on a net basis, whereby the tenant is responsible for all expenses related to the HVAC, parking lot, interior/non-structural elements, insurance, property taxes, and utilities. The landlord has responsibilities limited to the replacement of the roof, and structure.

About The Tenant - Heartland Dental is the nation’s largest dental support organization providing non-clinical, administrative support services to 2,800 supported dentists across 38 states. Heartland Dental partners with its supported dentists to deliver high-quality care across the full spectrum of dental services.

Georgia Office

(832) 602-3383

jonathan@phnlg.com

Texas Office

(972) 865-7991

nathan@phnlg.com

Alabama Office

(832) 602-4876

harrison@phnlg.com